Health Care Information

Crucial information regarding new health care forms you might be receiving this winter.

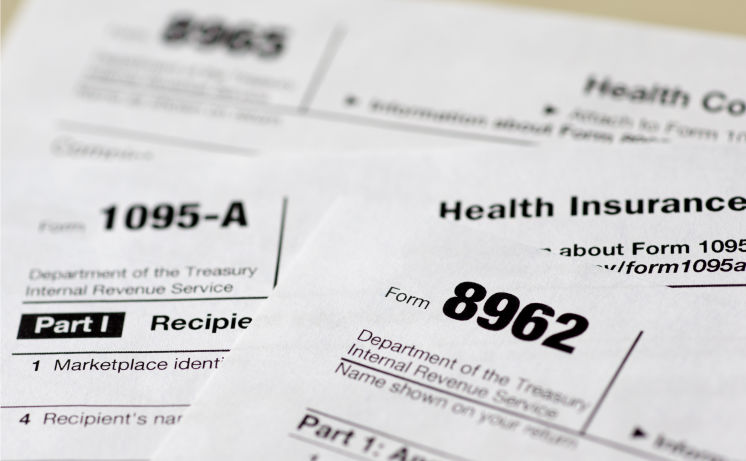

Because of the health care law, you might receive some new forms in the mail providing you with information about the health coverage you had or were offered in 2015. The information below is intended to help individuals understand these new forms, including who should expect to receive them and what to do with them.

1. Will I receive any new health care tax forms in 2016 to help me complete my tax return?

You may receive one or more forms providing information about the health care coverage that you had or were offered during the previous year. Much like Form W-2 and Form 1099, which include information about the income you received, these new health care forms provide information that you may need when you file your individual income tax return. Also like Form W-2 and Form 1099, these new forms will be provided to the IRS by the entity that provides the form to you.

2. What is the health care tax form that I might receive, if I was offered coverage from MileOne Automotive and I was a full-time employee (30 hours)?

Form 1095-C - Employer-Provided Health Insurance Offer and Coverage

3. When will I receive these health care tax forms?

The deadline for employers to provide Form 1095-C has been extended to March 31, 2016. This form should not be filed with your tax return. It is for informational purposes only. However, you should keep this form with your tax records.

4. Must I wait to file until I receive these forms?

It is not necessary to wait for Form 1095-C in order to file. Like last year, taxpayers can prepare and file their returns using other information about their health insurance. You shouldn’t attach any of these forms to your tax return.

5. Who should I contact if I have questions?

If you have any questions, please contact your HR Generalist or Payroll Representative.